Bitcoin Is Magic Internet Money

The Magical Origins of Bitcoin

Any sufficiently advanced technology is indistinguishable from magic.

Technology is a marvelous thing. We are so quick to accept things as they stand, rarely taking the time to reflect on how magical these modern miracles are in actuality. Much of what we take for granted today would be indistinguishable from magic to anyone living just a couple of generations ago. Take a smartphone, for example. A pocket-sized piece of glass that can retrieve any piece of information at any time, talk to you, understand you, recognize faces, read fingerprints, record audio and video, and take high-resolution photographs. It is a flashlight, a compass, a navigation system, a notebook, a calendar, a travel planner, and a million other things. It can hold more books than the Great Library of Alexandria and show you more movies than you could ever watch, even if you had hundreds of lifetimes. And now, it can also hold your money and be your bank.

As with all technology, you don’t necessarily need to understand how your smartphone works in order to use it. In the same vein, most people have no idea how an internal combustion engine works, yet they drive their car every day. They might have an approximate understanding—one that is good enough to have some faith in the thing they are using—but it will often remain just that: an approximate understanding. How lacking our knowledge of the inner workings of anything truly is becomes apparent as soon as that thing breaks down. Once the car refuses to start, the computer refuses to boot, or the router refuses to connect, our ignorance is laid bare. What is true for the marvels of the present will also be true for the marvels of the future: you don’t need to understand how everything works to use it successfully.

The best way to become acquainted with technology (or magic, for that matter) is to use it. There is no better way to learn how something works—how it can be useful to you—than hands-on experience. What’s true for cars and smartphones is also true for Bitcoin. It is true for most things in our world, even the most mundane. You probably don’t know every detail of how a lock works, but you know that failing to lock your car or the door to your house might lead to disaster. Similarly, you won’t have to learn all the intricacies of public-key cryptography and hashing functions to understand that mishandling your private keys might lead to disaster as well.

Modern Wizardry

The good thing about bitcoin is that you know exactly the number — the magic number of 21 million.

Garry Kasparov

Bitcoin is a child of the internet. The whitepaper describing it wasn’t published in a scientific journal but freely on the internet. Its software wasn’t created by a gargantuan software company but by a pseudonymous netizen. It wasn’t sold to the public; it was released online for free. Thus, it is quite fitting that Bitcoin’s first viral advertisement was not created by an ad agency but by an individual on the internet.

On February 18, 2013, theymos asked the Bitcoin community on Reddit if they had any ideas for a site-internal Bitcoin ad. An hour later, mavensbot submitted a glorious painting of an incredibly well-drawn and beautiful blue wizard.

One can only echo the words of ManboobsTheClown: “Perfect.”

The wizard took on a life of his own, conjuring himself onto t-shirts, socks, mugs, paintings, and other artwork. He was drawn and re-drawn many times, and the largest miracle he performed was that his description of Bitcoin stuck: Magic Internet Money.

Internet culture is weird, and arguably, Bitcoin culture is even weirder. This is not particularly surprising since the early adopters of any new system—be it a global communications network or magical cryptographic money that will inevitably uproot the monetary structure of this world—come from the fringes. Just like you had to be a little bit of an oddball to be online in the early days, you had to be a peculiar creature to be interested in Bitcoin in the first couple of years.

While we have truly come a long way from the early days, Bitcoin still is and will always be Magic Internet Money. It is magical, it is internet-y, and it is money. Really good money.

Satoshi Nakamoto: The First Bitcoin Wizard

First rule of magic: Don’t let anyone know your real name. Names have power.

As we have seen in Chapter 1, Bitcoin has a long intellectual pre-history. It didn’t appear out of nowhere. Its creator, however, did. Satoshi Nakamoto first popped on the scene with the announcement of the Bitcoin whitepaper on October 31, 2008. While Satoshi had some private correspondences with select people before that (most notably Adam Back and Wei Dai), the night of Halloween 2008 was when he wrote his first public email to the Cryptography Mailing List.

As he mentions in his writings, he had been working on the design of Bitcoin for over 1.5 years, mulling over the idea of electronic cash (and what transaction types might come in handy) for many years before that.

While little is known about Bitcoin’s pseudonymous creator, many have tried to reveal the identity of the person (or persons) behind Satoshi Nakamoto. So far, all attempts were either horribly misguided, wildly speculative, or both. To this day, all of them were inconclusive.

Probably the most prominent example of such an outing attempt was made by journalist Leah McGrath Goodman who identified Dorian Prentice Satoshi Nakamoto as Bitcoin’s creator. Dorian, a retired engineer who was 64-years old at the time, denied having anything to do with Bitcoin, mentioning that he only heard about it some weeks before the reporter broke the news and turned his life upside-down. After the media hype settled down, the Bitcoin community started to embrace Dorian as a stand-in for the face of Satoshi Nakamoto, producing memes and artwork in the process. The man became somewhat of a meme himself, and if the identity of Satoshi remains a mystery, he might forever be the face of Bitcoin’s inventor.

Over the years, multiple people came forward claiming to be the creator of Bitcoin. Ranging from the obscure to compulsive liars to the mentally challenged, nobody was able to prove that he1 is Satoshi—a claim that, thanks to public-key cryptography, would be as easy to prove as signing a message with one of Satoshi’s private keys.

Alas, without cryptographic proof, all that remains are outrageous claims and wild speculation. While some people are undoubtedly annoyed that their curiosity in regards to Satoshi’s identity isn’t stilled, I am not saddened by it. To the contrary. The fact that we do not know who Satoshi Nakamoto is is a feature, not a bug. A leaderless system must not have a leader. As Jimmy Song so succinctly remarked, “one of the greatest things that Satoshi did was disappear.”

Apart from his legacy that is Bitcoin, Satoshi left us with a collection of comments and writings that accompanied the code. His many public posts—as well as some private discussions he had with other cryptographers and early adopters of Bitcoin—are still available online. If you are interested in exploring the writings of Satoshi, the following two resources are probably the most complete archives to date: The Complete Satoshi, hosted by the Satoshi Nakamoto Institute, and The Book of Satoshi by Phil Champagne, which includes explanations and historical context in addition to Satoshi’s writings.

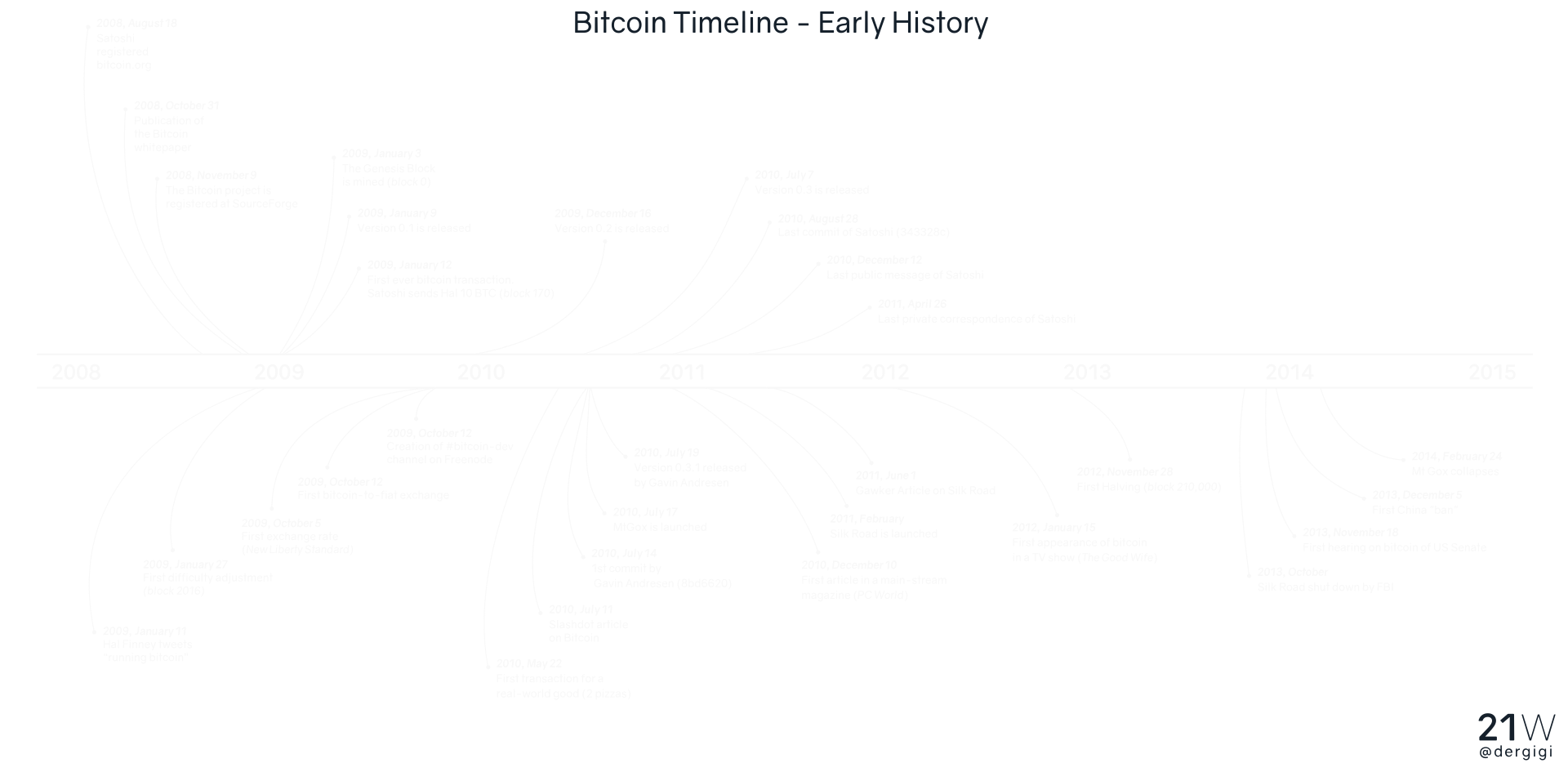

These writings allow us to sketch out a timeline of Satoshi’s activities, spanning from his sudden appearance in 2008 to his disappearance in 2010. The following is such a timeline along with important events in Bitcoin’s early history:

| Date | Time | Event |

|---|---|---|

| 2008-08-18 | Satoshi registered bitcoin.org | |

| 2008-10-31 | Publication of the Bitcoin whitepaper | |

| 2008-11-09 | The Bitcoin project is registered at SourceForge | |

| 2009-01-03 | 0 | The Genesis Block is mined |

| 2009-01-08 | Version 0.1 is announced and released | |

| 2009-01-11 | Hal tweets: Running bitcoin | |

| 2009-01-12 | 170 | First ever bitcoin transaction. Satoshi sends Hal 10 BTC |

| 2009-01-27 | 2,016 | First difficulty adjustment |

| 2009-10-05 | First exchange rate via New Liberty Standard | |

| 2009-10-12 | 24,835 | First bitcoin-to-fiat exchange |

| 2009-10-12 | Creation of #bitcoin-dev channel on Freenode | |

| 2009-12-16 | Version 0.2 is released | |

| 2010-05-22 | 57,043 | First transaction for a real-world good |

| 2010-07-07 | Version 0.3 is released | |

| 2010-07-11 | Slashdot article on Bitcoin | |

| 2010-07-17 | Mt. Gox is launched | |

| 2010-08-28 | Last commit of Satoshi (343328c) | |

| 2010-07-14 | 1st commit by Gavin Andresen (8bd6620) | |

| 2010-07-19 | Version 0.3.1 released by Gavin Andresen | |

| 2010-12-10 | First article in a main-stream magazine PC World | |

| 2010-12-12 | ~97,230 | Last public message of Satoshi2 |

So it came to be that after a little over two years, on December 12, 2010, Satoshi disappeared. Some of his final remarks were that “the project is in good hands” and that he had “moved on to other things.” A short time before he vanished, two of the most prominent projects of Bitcoin’s early history were launched: Mt. Gox and Silk Road. Both have magical origins: one used to deal with magic cards, the other with magic mushrooms.

| Date | Time | Event |

|---|---|---|

| 2011-02-27 | Silk Road is launched | |

| 2011-04-26 | Last private correspondence of Satoshi | |

| 2011-06-01 | Gawker Article on Silk Road | |

| 2012-01-15 | First appearance of bitcoin in a TV show (The Good Wife) | |

| 2012-11-28 | 210,000 | First Halving |

| 2013-10-02 | ~261,348 | Arrest of Ross Ulbricht and consequent shutdown of Silk Road |

| 2013-11-18 | First hearing on bitcoin of US Senate | |

| 2013-12-05 | First China “ban” | |

| 2014-02-24 | Mt. Gox collapses |

Magic Cards: The Mt.Gox Era

Magic: The Gathering is a popular card game played by millions of people around the world. Its playing cards are collectibles: some are rare and expensive (and oftentimes more powerful), others are relatively abundant and cheap. Each round of the game represents a battle between two or more wizards (the players) casting spells and summoning creatures (the cards). The original card game was released in 1993 by Wizards of the Coast, gaining in popularity from 2008 to 2016. Several expansion packs and editions were introduced over the years, including new cards, new game mechanics, and visual redesigns. At its height, the game was played by more than 20 million people, and more than 20 billion cards have been printed, according to the company. In 2002, the game moved to cyberspace with the introduction of Magic: The Gathering Online - the official online version of the card game.

It was this version that led Jed McCaleb to launch Mt. Gox, the “Magic: The Gathering Online eXchange.” What used to be a platform for Magic: The Gathering enthusiasts—a place which allowed you to trade these playing cards like stocks—would turn out to be the catalyst for one of the darkest chapters in Bitcoin’s short history.

McCaleb launched the site in 2007, years before Bitcoin was even a thing. The online marketplace didn’t really gain traction, and after a couple of months, he decided to discontinue the card trading platform. However, after reading about Bitcoin on Slashdot in 2010, he re-launched the site. This time, the focus wasn’t on trading Magic playing cards. This time, the focus was on trading Magic Internet Money.

Being one of the only sites where you could buy bitcoin, Mt. Gox quickly gained in popularity. By 2013 and into 2014, it was responsible for over 70% of all bitcoin transactions worldwide. After just three years, Mt. Gox became the leading bitcoin exchange and the world’s largest bitcoin intermediary. And then everything went South.

The downfall of Mt. Gox would probably be worth a book on its own. In short, due to negligence, incompetence, mismanagement, and probably more than a little bit of malice, Mt. Gox “lost” 850,000 bitcoin, which amounted to $450 million and around 7% of the total supply at the time. The company filed for bankruptcy at the end of February 2014. One month later, Mt. Gox claimed to have found around 200,000 coins again, bringing down the total amount missing to 650,000. Investigations revealed that most of the funds were stolen slowly over time, starting in late 2011. Today, ten years after the launch of the notorious bitcoin exchange, investigations and legal processes are still ongoing.

The silver lining to the Mt. Gox saga is that a lesson was learned. An incredibly expensive lesson, and a lesson that needs to be repeated over and over again, lest the history that is Mt. Gox will repeat itself: your keys, your bitcoin. Not your keys, not your bitcoin.

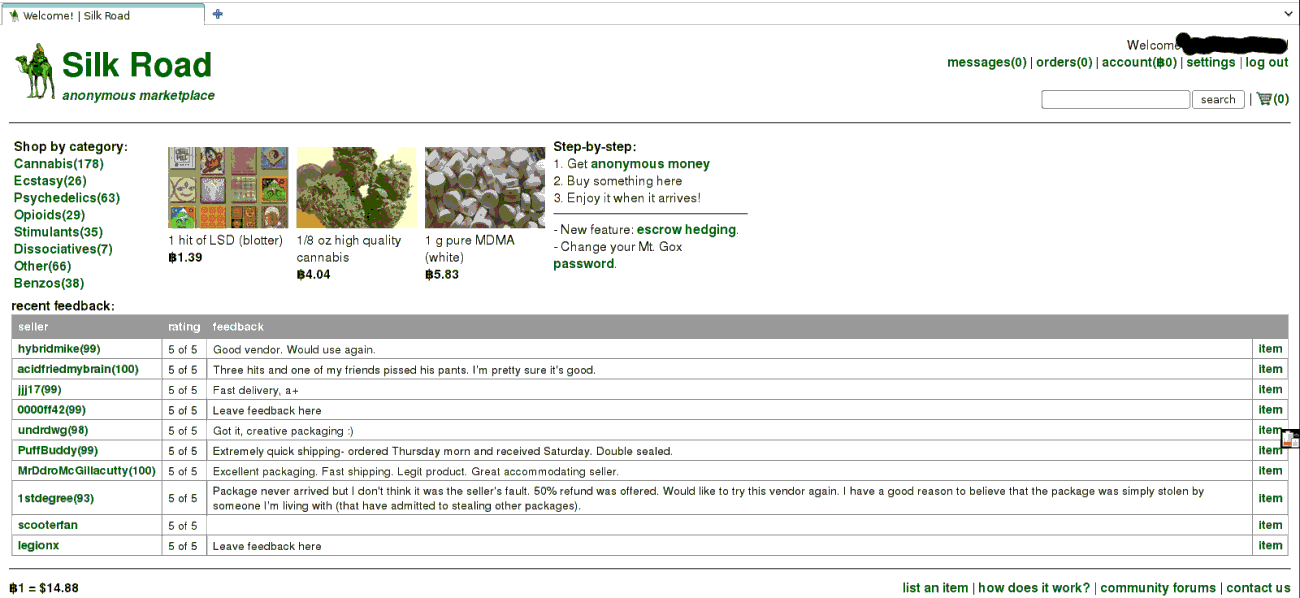

Magic Mushrooms: Silk Road

Probably the most notorious chapter of Bitcoin’s early history is the rise and fall of the Silk Road, an anonymous dark market that allowed individuals to buy and sell goods online—independent of their legal status. Launched by Ross Ulbricht in 2011, the Silk Road was a small community of buyers, sellers, and users of recreational drugs. Eventually, it became the place to buy drugs online. The eBay of drugs, as some called it. Today, we would probably describe it as the Amazon of drugs: a website where you could buy any substance from A to Z, and just a few days later, whatever you bought shows up in the mail.

Ross started to dream of an unrestrictive online marketplace around the same time that Satoshi worked on his ideas around Bitcoin. In line with libertarian ideals, he wanted the Silk Road to be a place where you could buy and sell any recreational substance, freely and directly. In his opinion, the government should have no say what a person shall or shall not put into their body. It should be the individual’s choice. Everyone should be allowed to decide for themselves.

At first, he wasn’t sure how to best realize this vision. Obviously, such an endeavor would be immediately shut down by law enforcement. But after a friend of his introduced him to Tor, a path to a technological solution began to emerge. Tor offers the possibility to hide any website or online service behind layers of obfuscation and encryption, which effectively enables someone to run such a site privately and anonymously. If nobody can figure out the location of the servers or the identity of the people that run them, nobody can intervene. However, one problem remained: payments. When Ross started thinking about implementing such an anonymous online market, he wasn’t yet aware of any way to send payments anonymously. Electronic cash was the missing ingredient of the soup that Mr. Ulbricht was cooking.

Bitcoin was the last piece of the puzzle that was required to turn the idea of the Silk Road into reality. Once Ross discovered the magic of the orange coin, he got busy. Now that he had all the tools, he was determined to build the site. The only thing that was left to do was to get his hands on a product that he could sell on his newly created marketplace. His product of choice was psilocybin mushrooms, which he grew himself in a small cabin off the grid. He was able to produce several kilos of these psychoactive mushrooms, telling only his girlfriend at the time about the whole operation. His plan was to work on the code for the Silk Road on the side, building the virtual marketplace while the first product was growing. He would announce the launch of Silk Road in several internet forums once the site was live - BitcoinTalk among others—interested people would figure out the rest. His plan worked, and a few weeks after the harvest, Ross Ulbricht became the first vendor on Silk Road, selling magic mushrooms in exchange for magic internet money.

What started as a website with magic mushrooms as its only listing eventually grew into something that was larger than even the most optimistic projections of its idealistic founder could have imagined. It is estimated that the Silk Road’s revenue exceeded 9.5 million bitcoin during the duration of its existence, amounting to hundreds of millions in US dollar terms. Some estimates go even as high as $1.2 billion. Other numbers are equally impressive: over one million transactions were facilitated between almost one million registered users, and the site listed tens of thousands of goods. Eventually, Ross Ulbricht, aka Dread Pirate Roberts, was caught and subsequently arrested, and the Silk Road was shut down.3

The story of Ross Ulbricht, his arrest, and the rise and fall of the Silk Road is as fascinating as it is captivating. It is a story of a young, ambitious, and highly intelligent guy that eventually became DPR: dreaded pirate and captain of the largest virtual drug ship the world has ever seen. A tale of idealism, love, multiple identities, corrupt FBI agents, hitmen, moral conundrums, betrayal, friendship, fake murders, real theft, and the blurry lines between good and evil. It is a story that will forever be interwoven with the early days of bitcoin. For many, the Silk Road was a gateway drug to the orange pill: the first contact with Magic Internet Money.

Ross is now serving a double life sentence plus 40 years without the possibility of parole, essentially for launching a website. While the whole story is nuanced and complicated, this is undoubtedly an exceedingly harsh penalty for committing non-violent crimes, especially since details of how the case was handled and evidence was obtained are questionable.4

Of course, ideas can’t be imprisoned. After the Silk Road was shut down, other “dark” marketplaces popped up, many of which exist to this day. Undoubtedly, dark and gray online markets will be with us for as long as global communication networks and strong encryption exist. What might be seen as atrocious by some is welcomed by others as a safer and more convenient way to obtain recreational drugs and pharmaceuticals that are either hard to obtain (because of price or the necessity for prescriptions) or illegal in their jurisdiction. Whatever your opinion of these matters might be, bitcoin, and the dark and gray markets it enables, are here to stay.

Due to its persistence and a relentless rise in price, the public perception of Bitcoin shifted from untraceable darknet money to speculative asset over the years. For some people, myself included, the perception shifted even further: from speculative asset to hard money and savings technology. However, I think it’s important to understand the early history of Bitcoin, including its early uses, the motivation behind them, and the reason why Bitcoin was chosen to solve the problems these early adopters faced.

How and why Bitcoin is used—as well as by whom—will undoubtedly keep changing over time. But whether you use it to buy magic mushrooms or not, Bitcoin will always remain Magic Internet Money.

Magic: Teleportation, Shapeshifting, and Invisibility

It’s hard to explain the magic of Bitcoin if you haven’t experienced it yourself. Receiving magic internet money for the first time is, well, magical! Hell, even after all these years in the Bitcoin space, I’m still enchanted. The fact that random people from the internet can teleport value directly into my otherworldy purse is nothing short of miraculous.

The fact that that these coins flow directly between you and me is absolutely magical. No intermediaries, no trusted third parties, no service to sign up to. Just you and me, communicating via a series of tubes.

The implications of this are as profound as they are fascinating. How does it work? Who is in charge? Where do these coins come from? Can I make more? These and a million other questions will pop into your head once you start to grasp the profundity of what just happened: Someone gave you something of value just by sending you a message!

Satoshi was probably the first person that alluded to the magical properties of Bitcoin. In one of his many forum posts, he wrote: “As a thought experiment, imagine there was a base metal as scarce as gold but with the following properties: boring grey in color, not a good conductor of electricity, not particularly strong, but not ductile or easily malleable either, not useful for any practical or ornamental purpose, and one special, magical property: can be transported over a communications channel.”

Of course, bitcoin is this magical base metal that Satoshi alluded to. The fact that it can be transported via any communications channel is astounding. It implies that the internet is not a necessity for Bitcoin. In theory, you could use pretty much anything to send (and store!) your bitcoin. Currently, the internet is by far the best communication tool we have. As of now, sending packets across the internet is Bitcoin’s preferred mode of communication. If you want to teleport some sats from point A to point B, you would probably use the internet to do so.

Due to its lack of physicality, there is no limit to what shape your bitcoin might have: text, QR codes, images, sound, artworks, emojis - the only limiting factor is our imagination (more on that in Chapter 17). Whether we are talking about storage or the transmission of transactions, Bitcoin can shapeshift into anything it needs to be. This magical property is, in part, what makes Bitcoin so resilient to censorship. Bitcoin transactions can be encoded into pretty much anything, and—of course—they can be sent via end-to-end encrypted communication channels, making them completely unrecognizable. How can you censor something if you can’t tell what you’re looking at?

But shapeshifting and teleportation aren’t Bitcoin’s only tricks. If I had to pick a favorite, I would probably pick bitcoin’s magical ability to disappear. And I don’t mean the “send me all your bitcoin and I will send you twice the amount back” kind of disappear, but the plausible deniability kind. In essence, all you possess is a magic spell: your private key, which holds the power to unlock your bitcoin so it can be teleported someplace else. Most people store this spell on a piece of paper (or a piece of steel, or a piece of specialized hardware). However, you can—with some effort—learn this spell by heart and move your bitcoin inside your brain, effectively making them vanish.

While this is a horrible idea if you suffer from amnesia, it could be incredibly useful if you are forced to resort to such drastic measures. Imagine all the people that had to flee their country at a moment’s notice, leaving all their valuable possessions behind. Now imagine if they had a meaningful portion of their net worth in bitcoin and the magic spell to unlock them in their head. They could cross the border naked with their wealth intact. There would be nothing for the border officers to find, and with a single “abracadabra,” our naked protagonists could restore their wealth once they arrived in a safe place. Magical, isn’t it?

Internet: The Double-Spending Problem

All computers are copying machines. The internet itself, in essence, is a gigantic copying machine. This, coincidentally, is also the reason why money on the internet didn’t exist until the invention of Bitcoin.

If you move a file on your computer, it doesn’t actually move as real objects do in the real world. It is copied, and after the copy is checked for errors, the original5 is deleted. Hence, the problem of money on the internet: if I want to move ten bucks from my computer to yours, the ten bucks are actually copied - bringing the total balance up to twenty bucks during the transfer—and you have to trust me that I will destroy my original ten bucks after you’ve received the copy. Could you trust me to do that? This, in a nutshell, is the double-spending problem. This conundrum is why most people thought that the internet can’t do money.

Money: Facilitating Trust

What do I mean when I say that the internet can’t do money? After all, there are credit cards, online banking, PayPal, Venmo, CashApp, AliPay, WeChat Pay, and many other services that allow you to send and receive money via the internet. However, they all have something in common: a middleman—usually a company—is required to make them work. That’s because you need to trust someone to do the accounting right. All because of that pesky double-spending problem!

In the physical world, we don’t have this problem. You give me an apple. Now I have the apple, and you don’t have the apple anymore. There is no copying process, i.e., no duplication and subsequent deletion. In the physical world, things move naturally from A to B without getting copied. In the physical world, you don’t need a middleman to facilitate transactions.

In cyberspace, the only solution to this problem was having a middleman—a trusted third party—manage the orderliness of transactions. Thus, by default, PayPal, VISA, MasterCard (and all other companies that process transactions) know exactly who paid what to whom at what point in time and for what reason. Knowledge is power, and this particular knowledge gives these trusted third parties the power to block transactions, freeze accounts, decline payments, and de-platform their customers. Further, as history has shown, this data will inevitably be leaked either by negligence, incompetence, or targeted hacks. Trusted Third Parties are Security Holes, as Nick Szabo would say.

Bitcoin does away with all that, which is in part why it is so magical. It behaves like real money in the real world: you hand me a dollar bill, and that’s it. The dollar bill doesn’t have to pass through somebody else to arrive at my hand. And why this dollar bill changed hands is nobody’s business but ours. We can tell others about it, but we are not forced to do so, and most importantly: we don’t have to ask for permission to make this transaction. Bitcoin behaves in the same way: you send me some sats, and that’s it. Now I have those sats, and you don’t.

Becoming a Bitcoin Wizard

Until very recently, you had to be a wizard to use Bitcoin. At least that’s what it felt like. Although Bitcoin came with a graphical user interface from day one, understanding the arcane concepts that make it work was (and still is!) like learning an ancient tongue. Private keys, public keys, hashing functions, cryptographic signatures, elliptic curves, remote procedure calls—for most people, there is simply no difference between these concepts and glyphs describing a magic spell.

If you understand some of these concepts already, congratulations! You have a head-start when it comes to understanding Bitcoin. However, the technical side of Bitcoin is only one piece of the puzzle. Remember: Bitcoin is magic internet money, first and foremost. Many technology-minded people mistake it for a technological invention and don’t see the peculiar properties which make it an astounding monetary innovation.

While using Bitcoin is getting easier every day, the days of the wizards aren’t numbered. To this day, Bitcoin experts discuss developments and ideas in the #bitcoin-wizards6 IRC channel, and Bitcoin is still embraced and described as magic internet money. The original wizard is evolving alongside Bitcoin, as is our idea of what a Bitcoin wizard is. Today, it is probably fair to say that the real wizards are the core developers, those who work on improvements at the base layer of the Bitcoin protocol.

Understanding Bitcoin is a process, an individual journey. You might end up becoming a bitcoin wizard yourself, just like the people that learned to code7 just to contribute to the Bitcoin project. And even if you don’t, I hope that these different ways of looking at Bitcoin will help you on your journey of understanding Bitcoin a little better. At least, I hope that you will shift your perspective on Bitcoin and what it is. While Bitcoin is and always will be Magic Internet Money, it is so much more in its entirety.

Many people who got sucked into the world of Bitcoin describe the experience as “falling down the rabbit hole.” Tipping your toes into this strange world of keys and hashes does indeed feel a little bit like entering Wonderland. Another metaphor that is often used is the “red pill vs blue pill” scene from The Matrix, where Morpheus offers Neo a red8 pill (the truth) and a blue pill (ignorance, but bliss). Neo chooses the red pill, and subsequently, he is bound to find out how deep the rabbit hole goes.

Similarly, I believe that the only way to understand Bitcoin’s magical properties is to experience it yourself. After you have set up a non-custodial wallet and written down your seed phrase with pen and paper, stop and realize that these words are the magic spell that can move your bitcoin. For all intents and purposes, these words are your bitcoin. Lose them, and they are gone. Memorize them, and you have bitcoin in your head. Magical.

With great power comes great responsibility, as Uncle Ben taught us. Bitcoin puts you in control, which, in turn, makes you responsible for your bitcoin. Once you get your hands on some sats, you can send them to anyone anywhere, without asking for permission, without any sign-ups or intermediaries. This, in turn, means that the onus is on you to be diligent and cautious. If you lose access to your funds, there is nobody to call. No one can help you to recover them. If you send funds to a scam artist, nobody can reverse this transaction or reimburse you for your gullibility.

This shift of trust and responsibility—from third parties to yourself - is what allows for the emergence of sound money from the Bitcoin network. But what differentiates sound money from an unsound one? And why do we need sound money in the first place? Answering these questions will be the focus of the next chapter.

So far, no female was bold or stupid enough to make such a claim. ↩

There is one later message, posted on March 7, 2014, in which Satoshi simply states that “I am not Dorian Nakamoto.” It is believed to be geniuine, although without cryptographic proof we can’t be sure. ↩

If you are interested in the details of this particular chapter of Bitcoin’s history, I would recommend Silk Road by Eileen Ormsby and American Kingpin by Nick Bilton, two great books on the topic. ↩

Free Ross is a petition that was launched to protest this grossly excessive sentence and fight for Ross Ulbricht’s clemency. ↩

Note that when dealing with pure information, it is a bit difficult to speak of “originals” and “copies” since information can be copied perfectly and physical location doesn’t necessarily make sense. ↩

My friend Rajarshi Maitra, for example. ↩

In Bitcoin, the pill to swallow is orange, of course. ↩

Translations

- 🔗 Chinese translation by BTCStudy

- 🎧 German audio by Chris

- 🔗 Spanish translation by Drizzt do Urden

- 🔗 German translation by Geronimo & Kid

- 🔗 Italian translation by Italian Satoshi

- 🔗 Malay translation by Jesper

- 🔗 German translation by Karl Klawatsch

- 🔗 Greek translation by Nina

- 🎧 French audio by Singe Ωptimiste

- 🔗 French translation by Sovereign Monk

Want to help? Add a translation!

🧡

Found this valuable? Can't support me directly?Consider sharing it, translating it, or remixing it in another way.