Chapter Zero

A Quick And Dirty Explanation

Explanations are clear but since no one to whom a thing is explained can connect the explanations with what is really clear, therefore clear explanations are not clear.

Paradoxes explain everything. Since they do, they cannot be explained.

Above all, Bitcoin is paradoxical. It is simple yet complicated, ever-changing yet unchangeable. A novel machine without any novel parts; a technological innovation that isn't really about technology. You can't touch it, yet it is hard money. You can't see it, yet it will show you a vision of the future. You can't possess it, yet thousands of people seem to be possessed by it.

All that makes Bitcoin notoriously difficult to understand - and even harder to explain. As John Oliver so succinctly quipped, "it's everything you don't understand about money combined with everything you don't understand about computers." While this is true, and while one doesn't have to necessarily understand bitcoin to use it, it helps to have a deep understanding of money and the technology that powers Bitcoin to truly appreciate the gravity of the situation. Unfortunately, even a basic understanding of Bitcoin requires some expertise in networks, markets, cryptography, game theory, mathematics, physics, computer science, and human behavior. If it were easy to understand and convey, hyperbitcoinization1 would be in the past, and we would be on a bitcoin standard2 already. As Satoshi remarked almost one year after his initial publication: "Writing a description for this thing for general audiences is bloody hard. There's nothing to relate it to."

While many people have tried to do exactly that - describe Bitcoin for general audiences - I'm not sure that such a thing is even possible. There truly is nothing to relate it to, so all metaphors, historical equivalencies, and explanatory shortcuts will miss the point in one way or another. It seems to me that the proverbial sat3 will drop for everyone individually, and without talking to you personally, I can't know what your hangups are. Maybe you think that Bitcoin has no intrinsic value, or that it can be shut down by governments, or that it will be hacked, or that it will be superseded by another technology, or that using it is unethical because of its energy consumption or illicit use. All these concerns are more or less valid at first, but, believe it or not, they fade away as your understanding of money in general—and Bitcoin in particular—increases. Alas, this understanding doesn't come easy. It seems that very few people are curious enough to put in the necessary work, which, in turn, means that most people will have to learn the hard way: they will have to deal with bitcoin out of necessity.

That being said, it is definitely possible to understand Bitcoin and the implications that its continued existence will bring about. If this weren't the case, there would be no bitcoiners, no bitcoin developers, and no individuals investing in Bitcoin's future. Everyone who was once bitten by the bitcoin bug has their own "a-ha!" moment to share, and my hope is that exploring this phenomenon from a vast array of perspectives will increase your chance of having such a moment.

Before we explore these different viewpoints in-depth, a quick and dirty explanation is in order. I will try to explain how Bitcoin works, what you can do with it, why it is important, who is behind it, what "bitcoin" is, and what its fundamental building blocks are.

How It Works

In essence, Bitcoin is a large spreadsheet that documents who owns how much of Bitcoin's internal units: sats, short for satoshis. This spreadsheet contains a record of all transactions that ever happened, in the form of "Alice sent 21 sats to Bob." To keep everyone honest, everyone gets a copy of this spreadsheet. Everyone can add entries at the bottom of it, as long as certain rules are followed. To do so, people are taking part in a kind of game, not too different from a lottery or sports competition. The odds are set up so that roughly every ten minutes, someone will win this competition, allowing them to add a batch of entries at the bottom. The spreadsheet has certain internal rules that prevent the modification of past entries. If you change these rules in a backward-incompatible way, other people will refuse to play with you, effectively kicking you from the network. It is these rules that make sure that all the accounting is done correctly, e.g., that the person who wants to send money actually has the money and that the money is sent to only one other person. In addition, these rules make sure that no money is created out of thin air, which in turn ensures that no more than 2.1 quadrillion sats (= 21 million bitcoin) will ever exist.

No single entity can change the rules because everyone on the network has to opt-in to changes voluntarily. All participants play according to their own rules. Thus, nobody is in charge of the rules. Everyone is free to participate. All you need is a computational device and an internet connection.

That's pretty much it.

If you know a thing or two about Bitcoin already, you will realize that what I called the spreadsheet is Bitcoin's (distributed) ledger, what I called batches of entries are Bitcoin's blocks, what I called a lottery is better known as mining, and what I called rules are, well, Bitcoin's consensus rules.

Granted, everything is a tiny bit more complicated than I make it out to be - it is a quick and dirty explanation, after all. However, I think that the mental framework of a large spreadsheet that everyone has a copy of is helpful. While this explanation of Bitcoin is undoubtedly imperfect, I strongly believe that the technical details of how Bitcoin works will become less relevant over time, just like the intricate details of how the internet works are irrelevant for most people today. Yes, you will have to learn some technical details to truly understand why Bitcoin is resistant to seizure and censorship, just like you have to learn some technical details to understand why the internet can't be easily shut down. However, you don't need to have a complete understanding of all the parts that make your car or your smartphone work to enjoy the benefits of using it. The same is true for Bitcoin. As with most things, the basic idea of what you can do with it is more important than how it works in detail.

What You Can Do With It

Bitcoin is money, first and foremost. It behaves like cash, meaning that you can use it without asking anyone for permission. This is true whether you want to receive it, spend it, or save it. The only thing you need to open a "Bitcoin account" is mathematics, and the only thing you need to send or receive payments is a communications channel.

As of today, this means that all you need is a smartphone and an internet connection. In principle, however, you can use any source of random information to create a Bitcoin wallet, and any communications channel to send and receive transactions. A pair of dice and a ham radio will work just as well as a smartphone and the internet, as Bitcoin enthusiasts have demonstrated in the past.4

Unfortunately, permissionless transactions and inflation-resistant savings aren't very attractive to most people. Until one is forced to understand the importance of these basic use cases, it is easy to dismiss Bitcoin as a speculative asset or mania. However, once your bank account gets frozen because you bought or sold the wrong thing, or your account gets closed because you dealt with the wrong person, or your savings get obliterated because of hyperinflation, or you are forced to flee your country and want to have your wealth intact, the question of "what can I do with bitcoin" becomes obsolete.

As time progresses, more and more people will be forced to understand the importance of Bitcoin simply due to the trajectory of the prevailing systems. The natural end-state of fiat money is hyperinflation, and the natural end-state of centralized control is authoritarian censorship. Bitcoin is the antidote to both of these ills.

Why It Is Important

Bitcoin radically changes our collective assumptions about what money is and who should be in control of it. The world is going digital, and it becomes more apparent every day that uncensorable and natively digital money is essential for a free society. In addition to that, Bitcoin is important because it offers an alternative to the debt-based money that the world is so addicted to. Bitcoin is independent of governments and corporations, and as its short history has shown, it is extremely resistant to subversion. This independence, combined with the unchanging nature of Bitcoin's monetary properties, makes bitcoin a valuable asset to be held by companies, individuals, and countries alike. With each passing day of Bitcoin's operation, trust in the system will increase, which will make its adoption and value increase. The earlier you will be able to understand this process, the better your position in a bitcoinized world will be.

It is worth pointing out that Bitcoin's mere survival is enough to put it on the world stage. Its incentive structure has put in motion a series of events that is best described as the ongoing bitcoinization of our world. Whether this process will be a gradual, multi-decade one, or a violent, single-digit year one is yet to be seen. I believe it will be the latter. I believe that Bitcoin's incentives are strong enough and its operation antifragile enough for it to absorb other monies and stores of value quicker than most expect. While the hyperinflations of the 21st century will happen independently of Bitcoin's existence, the economic reality that Bitcoin forces upon the rest of the world must not be underestimated. It is serendipitous that the ongoing digitization of our world coincides with the beyond-irresponsible money printing of central banks. This serendipity, combined with the exponentially increasing pace of change in our global society, is the perfect setting for what is aptly named hyperbitcoinization: a rapid, bitcoin-induced demonetization of currencies and other stores of value such as gold and real estate.

Who Is Behind It

The short answer is: we don't know, and it doesn't matter. It doesn't matter because Bitcoin is open and mathematical in nature. Everyone can inspect it and verify that it operates as expected. Just like we do not need to know who Pythagoras was in order to understand and use the Pythagorean theorem, we do not need to know who Satoshi Nakamoto was to use and understand Bitcoin. Similarly, asking the same question in regards to fire, the wheel, the internet, and electricity might not lead to satisfying answers. All these phenomena had inventors/discoverers, but these people don't have any influence over their creation/discovery anymore.

Bitcoin was released into the wild, and soon after, Satoshi disappeared. His gift to the world was leaving behind free and open-source software that spawns a global, public, permissionless peer-to-peer network, which in turn spawns uncensorable and natively digital money.

Bitcoin's history, where it came from, and what came before it will be the focal point of the first chapter. Bitcoin is an idea, and this idea didn't come out of nowhere. The quest for digital money is almost as old as the internet itself. It was just a matter of time until someone had the right idea and built a system that would actually work.

What It Is

What is Bitcoin? That's the 2.1 quadrillion sats question. It is what humanity is trying to figure out - and what this book is all about. I believe that the answer to this question depends on your point of view and how you are willing to perceive it. To paraphrase Morpheus5: "Unfortunately, no one can be told what Bitcoin is. You have to see it for yourself."

It is not readily apparent what people mean when they speak of Bitcoin. Some are talking about the network, some are talking about the asset, some are talking about the industry or community around it.

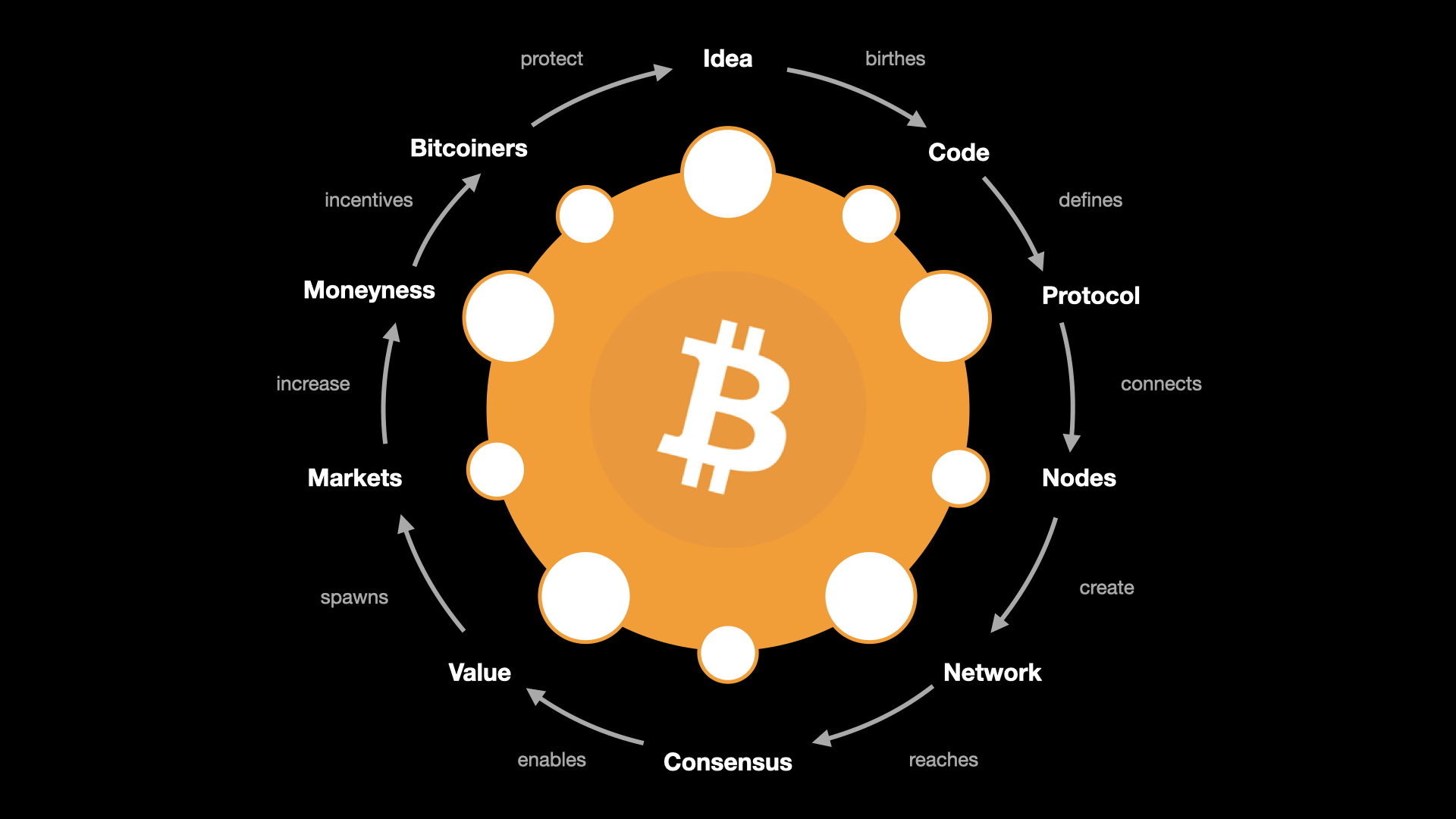

I had an epiphany a couple of years ago when trying to make sense of the elusive and circular nature of Bitcoin. At least one other person6 had a similar insight: Bitcoin is not only different things to different people, but it is many things at once, and we lack precise words to talk about it meaningfully. To make matters worse, all the things that we call Bitcoin are interconnected in a circular loop. Every part influences the whole.

In short, here is what "Bitcoin" is:

- Bitcoin is an idea.

- Bitcoin is software implementing this idea.

- Bitcoin is a protocol birthed by the software it represents.

- Bitcoin is a computer network comprised of nodes running the software.

- Bitcoin is an absolutely scarce asset emerging from the operation of the network.

- Bitcoin is a social movement comprised of individuals that are holding the asset and participating in the operation of the network.

- Bitcoin is a toxic, freedom-loving cult of unwavering believers; an intolerant minority from all backgrounds that will do everything in their power to defend the idea.

What follows is my attempt to break this loop apart, hoping that it helps to shine some light on this strange phenomenon. To do that, an explanation of some key concepts is in order.

Hyperbitcoinization is the final phase of the transitionary period in which humanity upgrades its monetary operating system from fiat money to bitcoin. ↩

The Bitcoin Standard is a book written by Saifedean Ammous, describing how bitcoin could be the base of a global sound monetary standard, similarly to how the world used to be on a gold standard in the past. ↩

In pre-bitcoin times, we would call this a penny. ↩

This is also why outlawing Bitcoin is a fool's errand. ↩

The son of Hypnos and the god of dreams. ↩

This person goes by the name of Deep Void and voiced his insight in a tweet. I explored this line of thinking in my Circularity thread and in various discussions. ↩

Translations

- 🎧 German audio by Rob

- 🔗 Russian translation by Tony

- 🎧 Russian audio by Tony

Want to help? Add a translation!

🧡

Found this valuable? Can't support me directly?Consider sharing it, translating it, or remixing it in another way.